© Copyright 2025, National Consumer Law Center, Inc. All rights reserved.

Caps on interest rates and junk fees are the primary vehicle by which states protect consumers from predatory lending. Forty-five states and the District of Columbia currently cap interest rates and loan fees for at least some consumer installment loans, depending on the size of the loan. However, interest rate caps vary greatly from state to state, some states allow lenders to pile on junk fees, and a few states do not cap interest rates at all. We recommend an airtight annual percentage rate (APR) cap of no more than 36% for small loans of up to $1,000. Rate caps should be significantly lower for larger loans, as even a 36% rate cap can pile on thousands of dollars in interest.

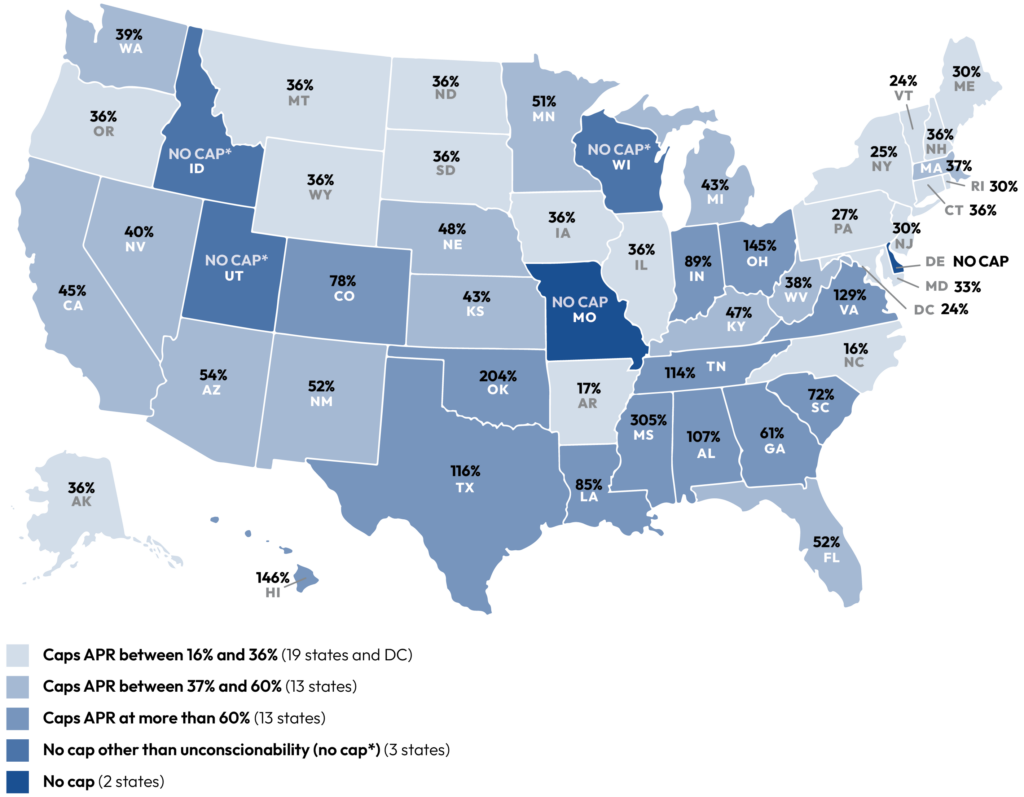

Map 1: APRs Allowed for a Six-Month $500 Installment Loan

This map shows the maximum APRs allowed by the states for closed-end installment loans (loans in which the amount borrowed and the repayment period are set at the outset) by licensed non-bank lenders.

For a $500, six-month installment loan, 45 states and DC cap rates, at a median of 39.5% APR.

- 19 states and the District of Columbia cap the annual percentage rate (APR) between 17% and 36%.

- 13 states cap the APR between 37% and 60%.

- 13 states cap the APR at more than 60%.

- Three states—Idaho, Utah, and Wisconsin—require only that the loan not be “unconscionable” (a legal principle that bans terms that shock the conscience).

- Two states—Delaware and Missouri—impose no cap at all.

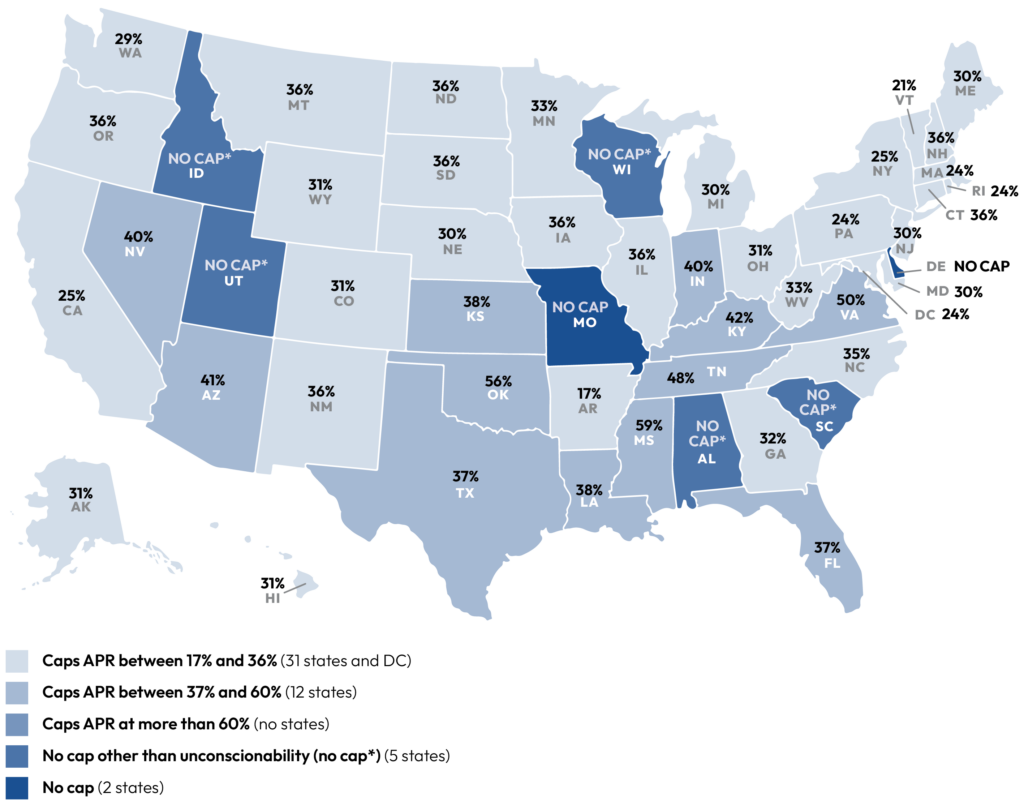

Map 2: APRs Allowed for a Two-Year $2,000 Installment Loan

This map shows the maximum APRs allowed by the states for closed-end installment loans by licensed non-bank lenders.

For a $2,000, two-year installment loan, 43 states and DC cap rates, at a median of 34% APR.

- 31 states and the District of Columbia cap the APR between 17% and 36%.

- 11 states cap it between 37% and 60% APR.

- Five states—Alabama, Idaho, South Carolina, Utah, and Wisconsin—require only that the loan not be “unconscionable.”

- Two states—Delaware and Missouri—impose no cap at all.

Details about our methodology can be found in Appendix A, and citations to the state laws in Appendix C.

Why States Should Cap Interest Rates and Fees

Caps on interest rates and loan fees are the primary vehicle by which states protect consumers from predatory lending. In the absence of caps, exploitative lenders move into a state, overwhelming the responsible lenders and pushing abusive loan products that trap low-income consumers in never-ending debt.

“It was like I asked for help to dig out of this hole and just created a deeper hole for me to inhabit.”

NPR interview of Sarah Ahmed who borrowed $2,300 at 98% to rent an apartment and get her young son set up in an after-school program.

Interest rate caps are more than numbers: they are reflections of society’s collective judgment about moral and ethical behavior. Prohibitions on usury go back millennia. Interest rate caps embody fundamental values.(1) Interest rate caps also reflect an assessment about the upper limits of sustainable lending that does not undermine individual or societal economic stability. When states eliminate high-cost loans by imposing rate caps, consumers generally agree that they are better off and express relief that the loans are no longer available.(2) Elimination of high-cost loans spurs an increase in affordable loans, benefiting all borrowers.(3)

Rate caps also encourage lenders to ensure that the borrower has the ability to repay the loan. Excessive interest rates enable lenders to profit from loans even if many borrowers eventually default.(4) The lender has little incentive to ensure that each borrower can actually afford to repay the loan in full on its terms if the lender can be made whole even if the borrower defaults, or can recoup defaults from exorbitant rates on others.

High-cost loans, including high-cost installment loans, have a disproportionate impact on communities of color.(5) Use of high-cost non-bank installment loans increased between 2021 and 2022 only for Black and Latino/Hispanic households, almost tripling for Black households.(6) High-cost lenders have long targeted these communities.(7) High-cost loans do not promote financial inclusion. Instead, they add to debt, increase financial struggles, drive borrowers out of the banking system, and exacerbate existing disparities.(8)

The APR is an Essential Standard for Measuring and Comparing the Cost of a Loan

The rates listed above are the annual percentage rates (APRs) as calculated under the Truth in Lending Act (TILA) for installment loans. The APR is a critical way to measure and compare the cost of a loan, because it takes into account both interest and fees, and the length of the repayment period. Otherwise, lenders could pile junk fees on top of interest without reflecting the full cost of the loan in the APR.

For example, a $500 line of credit offered by a predatory lender in Pennsylvania in 2006 charged just 5.98% interest, but required a $149 junk fee every month, producing an actual APR of 431% if repaid over six months.

The APR provides a common, apples-to-apples comparison of the cost of two different loans, even if they have different rate and fee structures or are used to borrow different amounts for different periods of time.(9) For example, a payday loan at 360% APR is 10 times more expensive than a 36% APR credit card would be if both were used to borrow $500 for 14 days.

The APR is a rate that measures how expensive a loan is whether the term is short or long, just like miles per hour is a useful measure of speed even if you are traveling for only a few minutes, not a full hour. Some lenders have diverted attention from the APR to focus instead on the dollar cost. But $15 for a $100 loan is a lot more expensive if you have the loan for only two weeks and not a full year – just as a $100 charge for a taxi ride would be far more costly for a one-block trip than for a 20-mile trip.

The Military Lending Act (MLA), which places a 36% cap on loans to members of the military and their families, calculates the cap as a “military APR” (MAPR). The MAPR takes into account not just interest and fees but also credit insurance charges and other add-on charges, so more fully reflects the cost of credit. The MAPR is also far more accurate than the TILA APR for measuring the cost of open-end credit such as lines of credit, because it includes fees that are excluded from the TILA APR for open-end credit. Because of this, the MAPR is the gold standard for measuring the cost of a loan.(10) However, because of the difficulty of identifying, in the abstract, the cost of credit insurance and other add-ons allowed by the various state laws (as opposed to calculating the MAPR for a given loan), we have used the TILA APR rather than the MAPR in the rates displayed above.

Why a 36% Maximum for Small Loans, Lower for Larger Loans?

The 36% rate cap is a widely accepted measure of the top acceptable rate for a small dollar loan, and the rate has been broadly supported by both lenders and the general public as the maximum cost for small loans.(11) But 36% is still a very high rate. States that have lower rates should not raise their rates to that level, and states that allow 36% for all loans should lower their rates for larger loans.

For loans in the thousands of dollars, 36% is far too high. Interest increases dramatically with larger, longer loans, even if the rates are not in the triple digits.(12)

Many states recognize the need for lower rates on larger loans by adopting tiered interest rate caps. For example, Wyoming allows 36% on the first $1,000 and 21% on the |remainder, with no additional fees.(13) For a five-year $10,000 loan, the borrower will pay $6,972 in interest, and the borrower’s monthly payment will be $282.86. If the state allowed 36% on the whole amount, the same loan would cost the borrower $11,680 in interest—$4,708 more.

Accordingly, a tiered structure that lowers rates as loans get bigger is appropriate.

Significant Changes in the States Since Mid-2024: Increased APRs in Several States

Since mid-2024, several states that already allow high-cost installment loans have made their laws even more predatory-friendly. Missouri added a new fee that lenders can charge, Mississippi extended the sunset date of a law that allows APRs over 300% and allowed that rate to apply to a wider range of loans, and Tennessee increased both the interest rate and the fees it allows a lender to charge. In addition, Oklahoma’s and Texas’s APR caps keep creeping upward due to annual adjustments of these states’ already high fees and the loan sizes for which higher interest is allowed.

Details about the new laws:

Missouri added another fee to the list of add-on fees a lender is allowed to charge: a fee equal to the cost of a credit report. 2024 Mo. Leg. Serv. S.B. 1359. Since Missouri places no limit on the amount of interest a lender can charge for an installment loan, allowing this new fee is unlikely to have any significant effect.

Mississippi’s highly abusive Credit Availability Act, which allows APRs over 300% on installment loans, was scheduled to sunset in 2026, but the state extended the sunset date to July 1, 2030. The same bill increased the maximum amount of a loan under this law from $2,500 to $3,250, and provided that it would be adjusted annually for inflation. 2025 Miss. Laws Chapter 367.

Oklahoma announced inflation adjustments for a “closing fee,” increasing it from $184.64 to $190.41, and for monthly fees allowed under one of its calculation methods. As a result, the maximum APR for a $2,000 2-year loan increased from 54% to 56%.

Tennessee increased a maximum interest rate from 30% to 36%, and allowed this higher rate to be applied to all loans of $100 or more, not just loans between $100 and $5,000. It also increased an origination fee from 10% to 12.5% of the principal. 2025 Tenn. Laws Pub. Ch. 70 (S.B. 694). As a result, the maximum APR for a $500 6-month loan increased from an already high 106% to 114%, and the maximum APR for a $2,000 2-year loan increased from 43% to 49%.

The Texas Finance Commission adjusted a number of fees upward for inflation, resulting in higher APRs for loans of various sizes (but not the $500 and $2,000 loans addressed by this report).

Appendix B summarizes earlier changes in state lending laws, going back to 2017.

Recommendations: A 36% APR Cap for Small Loans, Lower for Larger Loans

To protect consumers from high-cost lending, states should:

- Cap APRs at no more than 36% for small loans, such as those of $1,000 or less, with significantly lower rates for larger loans.

- Prohibit loan fees or strictly limit them to prevent fees from being used to undermine the interest rate cap and acting as an incentive for loan flipping.

- Include all payments in the APR calculation, whether or not they are deemed “voluntary.” Some lenders have tried to disguise fees as purportedly voluntary “tips,” “expedite fees,” or donations.

- Prevent loopholes for open-end credit. Rate caps on installment loans will be ineffective if lenders can evade them through open-end lines of credit with low interest rates but high fees.

- Ban the sale of credit insurance and other add-on products, which primarily benefit the lender and increase the cost of credit.

- Examine consumer lending bills carefully. Predatory lenders often propose bills that obscure the true interest rate, for example, by presenting it as 24% per year plus 7/10ths of a percent per day instead of 279%. Or the bill may list the per-month rate rather than the annual rate. Focus on the full annual cost and calculate the APR, including all interest, all fees, and all other charges. Reject the bill if it is over 36% (or if it applies a 36% APR to more than the very smallest loans).

- Avoid loopholes and include anti-evasion provisions to prevent lenders from laundering their loans through out-of-state banks to evade state rate caps or disguising their loans as sales, “earned wage access,” or other devices.

In addition, states should make sure that their loan laws address other potential abuses. States should:

- Require lenders to evaluate the borrower’s ability to repay any credit that is extended.

- Prohibit mechanisms, such as security interests in household goods and post-dated checks, which coerce repayment of unaffordable loans.

- Require proportionate rebates of all up-front loan charges when loans are refinanced or paid off early.

- Limit balloon payments, interest-only payments, and excessively long loan terms. An outer limit of 24 months for a loan of $1,000 or less and 12 months for a loan of $500 or less might be appropriate, with shorter terms for higher-rate loans.

- Employ robust licensing and reporting requirements, including default and late payment rates, for lenders.

- Provide strong enforcement mechanisms, including making unlicensed or unlawful loans void and uncollectible, and allowing a private right of action with attorneys’ fees.

- Tighten up other lending laws, including credit services organization laws, to prevent evasions.

See NCLC’s 2015 report on high-cost small loans for more details on these issues and on issues that arise for open-end credit. In addition, see our Rent-a-Bank Lending and Fintech & Disguised Credit pages for more information about the latest issues.

In the absence of rate limits at the federal level, state interest and fee caps are the primary bulwark against predatory lending. By following these guidelines, states can ensure that their laws are effective at protecting consumers.

Authors and Acknowledgments

Co-authors: Carolyn Carter, senior attorney, NCLC; Margot Saunders, senior attorney, NCLC; Lauren Saunders, associate director and Director of Federal Advocacy, NCLC.

This research was funded by the Annie E. Casey Foundation, and we thank it for its support; however, the findings and conclusions presented in this report are those of the authors alone, and do not necessarily reflect the opinions of the Foundation. The authors thank NCLC colleagues Emily Green Caplan, Michelle Deakin, Ella Halpine, Anna Kowanko, Stephen Rouzer, Diane Thompson, and Odette Williamson for assistance.

Related Resources

- NCLC’s High-Cost Loans online content

- Issue Brief: After Payday Loans: Consumers Find Better Ways to Cope with Financial Challenges (Mar. 2022)

- Issue Brief: Why Cap Interest Rates at 36%? (Aug. 2021)

- Report: Predatory Installment Lending in the States: How Well Do the States Protect Consumers Against High-Cost Installment Loans? (Nov. 2024)

- Report: Larger Loans Need Lower Rates: A 50-State Survey of the APRs Allowed for a $10,000 Loan (Mar. 2024)

- Issue Brief: Comparing APRs of Small Loan Alternatives (Jan. 2025)

- Report: Misaligned Incentives: Why High-Rate Installment Lenders Want Borrowers Who Will Default (July 2016)

- Report: Installment Loans: Will States Protect Borrowers from a New Wave of Predatory Lending? (July 2015)

Prior APR Reports:

See all resources related to: High-Cost Credit