So-Called “Earned Wage” Advances Are Disguised Payday Loans

A lawsuit filed by the New York Attorney General against DailyPay reveals a business model built around trapping low-wage workers into paying hundreds of dollars in fees each year. DailyPay recruits employers by touting “tremendous benefits to the employer … all for a price tag of $0 to the business” but counts on over $300 a year in fees from workers. One worker took out over 450 loans and paid nearly $1,400 in fees over two years.

DailyPay offers advances of “earned wages,” repaid on payday. It pushes workers to take out multiple small loans and pay multiple fees each week, putting them in a cycle where they must reborrow to fill holes in their paycheck but still end up behind. These findings come from the Attorney General’s review of over four years’ worth of data.

Not free

- DailyPay markets advances as “no interest” or “interest free” but collects fees on roughly nine out of every 10 advances. Fees are $2.99 to $3.99 for instant advances (almost all are instant) and $0 to $1.99 for those who choose a 24 to 48 hour delay.

Hefty costs on tiny, brief loans

- The median advance was $77.07 for eight days, with a median APR of 193.47% and an average 398.59% APR.

- The single most common loan, $20 for seven days for $2.99, had an APR above 750%.

Fees multiply with workers stuck in borrowing treadmill

- Over 55% of workers in the most recent data obtained two or more advances/week, making up 75% to 80% of revenue.

- More than one in four users now take advances every other day.

- The top 10% of users took out 5.7 advances a week – nearly 300 loans a year.

- Nearly three in five advances were within two days or less of the prior loan.

Tricks to push frequent borrowing

- DailyPay sends alerts about “new earnings in your DailyPay account” when hours are updated in payroll, resulting in a repeated prompt to trigger frequent use.

- NY explains that DailyPay “encourages harmful behavior, telling employees they ‘deserve to be paid every day.’”

Fees generate high revenues for DailyPay, high costs for workers

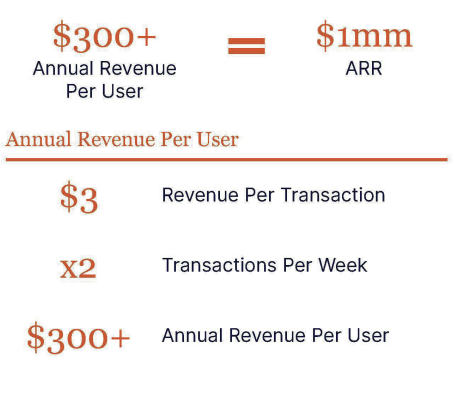

- DailyPay’s “Powerful Business Model” generates over $300 in fees a year per user.

- Nearly half of revenue comes from workers who pay hundreds of dollars a year in fees.

- Total fee revenues extracted from New York workers exceeded $27 million.

See all resources related to: High-Cost Credit