Earned wage advances (EWA) are a form of payday loan. Fees appear small but can pile up in hidden ways and drain low wages.

“Tip”-based fintech payday loans with no connection to wages can be even more expensive, 498% APR or higher, and can trigger overdraft and nonsufficient fund fees.

Neither employer-based EWAs nor other fintech payday loans should be allowed to evade interest rate limits and other protections that apply to other loans.

EWAs and “Tip”-Based Advances are Loans. Exempting them from Lending Laws will Permit Evasions by Payday Lenders.

EWAs are loans – an advance on future pay not yet due, repaid on payday. They are not wage payments; labor laws prohibit employers from charging fees for paying wages. In many states, lending laws explicitly cover payments made for the sale or assignment of wages.

Industry lobbyists are pushing exemptions from lending laws for EWAs and tip-based advances. These exemptions would enable new forms of fintech payday loans and also allow traditional payday lenders to claim that their loans, too, are based on earned but unpaid wages.

Fees Look Small but Drain Wages and Could Add Up to 498% APR

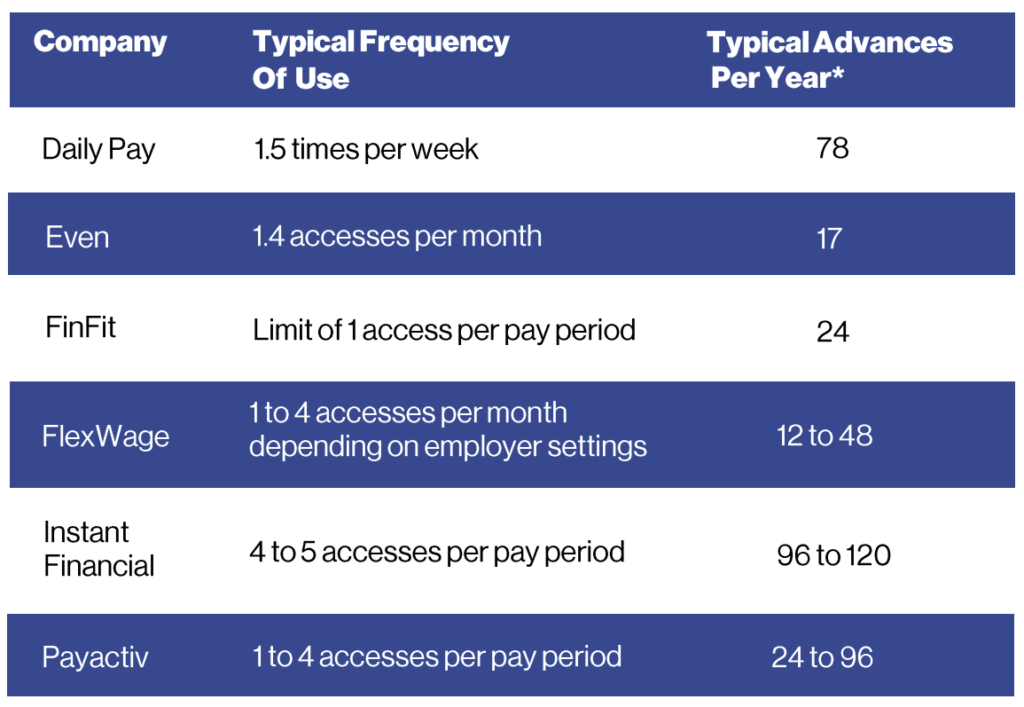

*NCLC calculations assuming semi-monthly pay.

Like traditional payday loans, EWAs are balloon-payment loans that lead to a cycle of reborrowing. A worker who cannot afford an expense from this week’s pay and borrows from next week’s will have a hole, triggering another loan. Most workers who use EWAs do so nearly every pay period – 12 to 120 times a year, with an average of 36 times.

Some employers offer early pay for free, but most EWAs charge $1 to $2 per advance, plus $1 to $2 “expedite” fees for quick access. Two advances a week at $3 each could cost over $25/month – likely several hours’ wages. On average, workers pay over 330% APR.

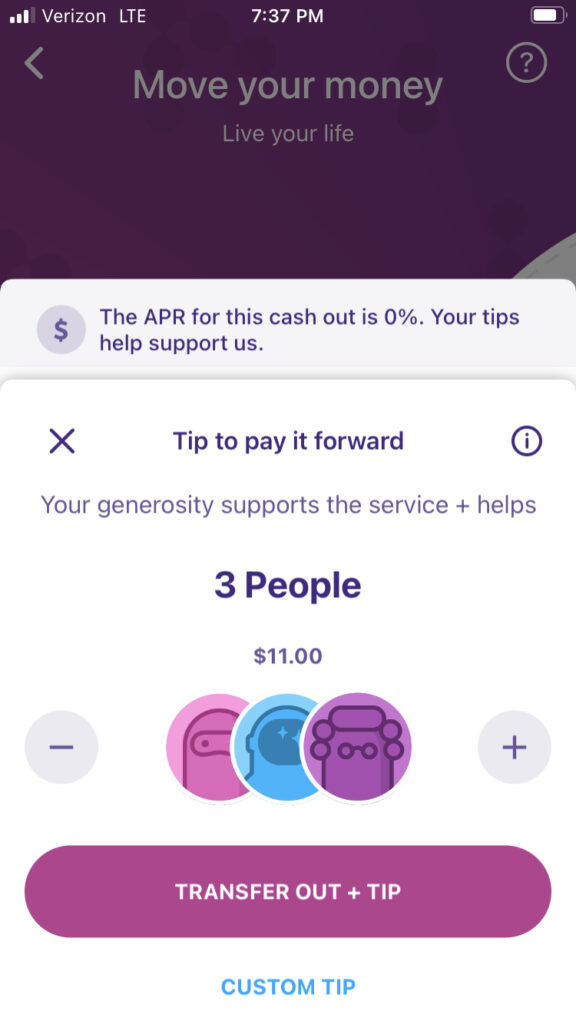

Direct- to-consumer fintech payday loans claim to pay wages but have no connection to payroll and are repaid, like other payday loans, by debiting bank accounts. Workers are steered into paying purportedly voluntary “tips” with hidden tricks to make not tipping difficult. One app adds an $11 “tip” for a $100 advance for 11 days, but displays “0% APR.” With a likely $4 expedite fee included, the cost is the equivalent of 498% APR. Repayment can also trigger overdraft or nonsufficient funds fees. Fake earned wage advances and other fintech payday loans that request “tips” collect them 73% of the time.

Recommendations for Employers and Policymakers

Policymakers and employers should not endorse disguised payday loans that merely lead workers into paying to be paid, draining low wages. Instead:

- Employers: Pay a living wage, offer regular work schedules, and offer early pay, if at all, for free.

- Regulators: Treat all advances as credit, apply interest rate and fee limits to all payments, including “voluntary” ones, and supervise providers. At most, for employer-based EWAs only, exempt no more than $5/month total from usury limits.

See all resources related to: Banking, Payments & Remittances