Every state has a set of exemption laws, intended to prevent creditors from pushing families into destitution. This report finds that few states’ exemption laws meet even the most basic standards.

Exemption laws are designed to protect consumers and their families from poverty, and to preserve their ability to be productive members of society and achieve financial rehabilitation.

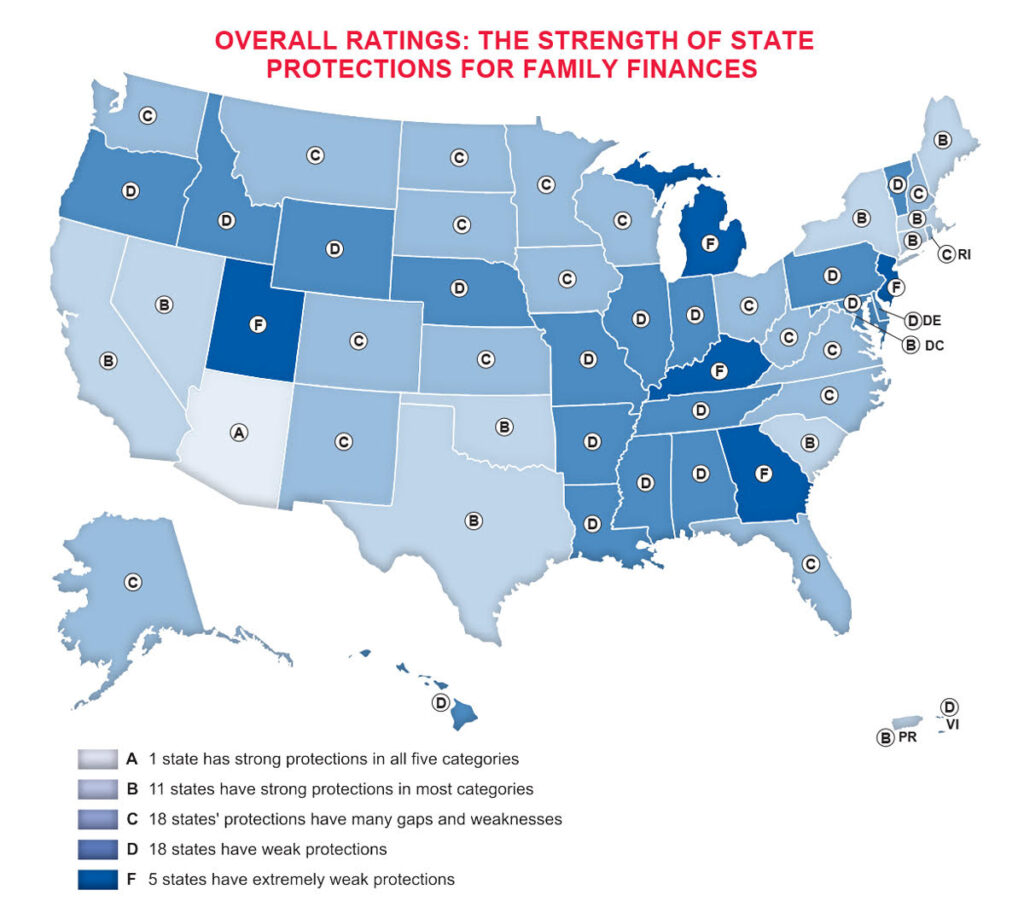

These protections are particularly important as soaring inflation drives up the cost of basic necessities and families no longer have pandemic protections to fall back on. Yet not one jurisdiction meets basic standards. This report details the extent to which states protect families and provides ratings in each of these five areas:

- Preventing creditors from seizing so much of the debtor’s wages that the debtor is pushed below a living wage;

- Allowing the debtor to keep a used car of at least average value;

- Preserving the family’s home—at least a median-value home;

- Preserving a basic amount in a bank account so that the debtor’s funds to pay essential costs such as rent, utilities, and commuting expenses are not cleaned out; and

- Preventing seizure and sale of the debtor’s necessary household goods.

Best states

Arizona went from a D in last year’s report to the highest grade in the nation with an A this year. An Arizona ballot initiative increased a wide array of protections, from wage and bank account seizure to the family home and household goods, but the state still falls short of protecting a living wage.

Massachusetts, which modernized its archaic exemption laws in 2010, and Nevada, which also recently improved its laws, come next closest to meeting these five basic standards, each rating a high B grade. Solid B states include Connecticut, the District of Columbia, Maine, Puerto Rico, and Texas, while California, New York, Oklahoma, and South Carolina rate low B grades.

Worst states

At the opposite end of the scale are several states whose exemption laws reflect indifference to struggling debtors. These states allow creditors—or the debt collectors they hire–to seize nearly everything a debtor owns, even the minimal items necessary for the debtor to continue working and providing for a family. Georgia, Kentucky, Michigan, New Jersey, and Utah are the worst and rate an F. Meanwhile, Arkansas, Pennsylvania, and Wyoming are nearly as bad, rating low D grades.

During the past 12 months, several states amended their laws to make improvements in these protections. Arizona, California, and Colorado made particularly significant improvements. In addition, California passed S.B. 1099, effective January 1, 2023, which improves the exemptions available to a debtor who files bankruptcy.

Key Recommendations

State exemption laws should be reformed to:

- Protect a living wage from seizure by creditors.

- Automatically protect a reasonable amount of money on deposit so that families can meet several months of basic needs such as rent, daycare, utility bills, and commuting expenses.

- Preserve the debtor’s ability to work, by protecting a working car, work tools and work equipment.

- Protect the family’s housing and necessary household goods.

- Protect retirees from destitution by restricting creditors’ ability to seize retirement funds.

- Be automatically updated for inflation.

- Close loopholes that enable some lenders to evade exemption laws.

- Be self-enforcing to the extent possible.

See all resources related to: