A New York Attorney General (NY AG) lawsuit shows how costly “earned wage” payday loans can be — up to hundreds of dollars a year. The lawsuit accuses MoneyLion of denying that its cash advances are loans and of disguising interest as instant access fees and “tips.” MoneyLion offers advances directly to consumers and debits bank accounts on payday. The AG’s complaint analyzed over five years of data and accused MoneyLion of many unsavory practices, including:

Disguising usurious interest

- MoneyLion discloses “0% APR” but nearly nine of 10 advances had fees, and the average cost with fees and tips was over 800% APR. The most common loan, $100 for $8.99 for two weeks, was equal to 234% APR.

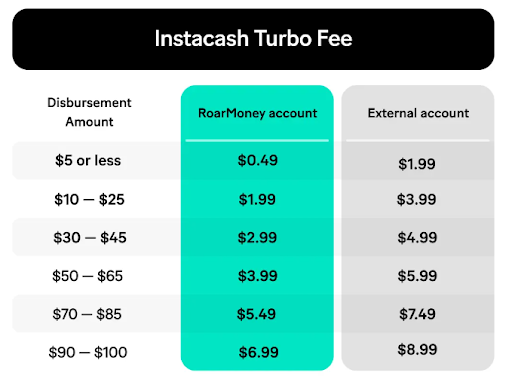

- To get “Instacash” instantly, rather than in 48 hours or longer, users must pay a “Turbo” fee as high as $8.99 even though the cost of sending money instantly is, at most, pennies. The fee starts at $0.49 but increases quickly as the loan does – just like interest.

- MoneyLion automatically includes Turbo fees, requiring users to navigate to separate screens

to remove the fees and artificially delaying deposits for users with RoarMoney accounts

who decline to pay Turbo fees. - MoneyLion pressures users “relentlessly” to “tip,” implicitly threatening negative consequences for users who do not tip, inducing guilt, pushing for a tip on the last loan before giving a new one, and highlighting preferred tip amounts. About 40% of advances included tips.

Reducing loan size to increase fees

- MoneyLion touts “up to $500 any day” but limits advances to $100, so five advances with five Turbo fees are needed to get an instant $500 loan. Users took out nearly two million advances minutes after a prior advance.

- In an effort to reduce the average loan from $60 to $50 to increase “tip rate as a % of principal,” MoneyLion planned to limit more users’ initial loans to $25 and to employ “other UX [user experience] mechanics to encourage smaller amounts.”

Profiting from frequent borrowers stuck in a debt trap

- 40% of users paid fees for 10 or more advances a month, with 44% of fees and tips coming from users taking two or more advances per week.

- One in five users took an advance every other day and regularly incurred fees and tips of $57/month, generating about half of all fees and tips. The 10% of most frequent users pay hundreds of dollars annually.

- The AG explained: “Facing fresh shortfalls, Instacash users go back for more, piling up new amounts owed, more fees, and higher tips each time, until they are utterly dependent on regular and repeat access to MoneyLion’s high-cost Paycheck Advances.”

Triggering overdrafts with mistimed debits

- MoneyLion “relies on its own projections of future direct deposits, not any concrete evidence that the user … has ‘earned’ any wages”.

- MoneyLion attempts to debit accounts instantly when payroll is predicted but “regularly receives complaints” about debits that trigger overdraft and other fees.

- Employees are instructed to “retry payments every day until repaid” and if “there is not enough in the customer’s accounts, we may take a partial repayment and try again the next day.”

Imposing hurdles on ability to avoid obligation to repay

- MoneyLion claims users have no obligation to repay but makes it “needlessly difficult” to “navigate an unintuitive and … complex process across multiple menus” to stop repayment, requires three business days’ notice, and makes revocation “entirely impossible” for advances with short terms.

- Excluding likely bad actors with more than five accounts on a single device, the collection rate was nearly 98%.

See all resources related to: Banking, Payments & Remittances, High-Cost Credit